Fully online self-serve retirements

Treat your pension scheme members to a true, end-to-end self-serve retirement journey.

Take the strain out of the retirement process for your administrators and members.

What is a self-serve retirement process?

It’s a quick and easy online feature that allows pension scheme members to produce multiple quotes, choose their retirement options, and instigate the transition to pensioner status.

When they’re ready to retire, they can complete the whole end-to-end process through IntelliPen’s online member portal.

IntelliPen puts a member’s retirement into payment and converts them to pensioner status by automatically:

- calculating payments and lump sums

- disinvesting any additional voluntary contributions (AVCs) they may have

- checking and verifying their identity

- scheduling payment dates

- initiating and paying out their chosen settlement

BTPS member: “That was the best service ever. From deciding to take my pension to receiving the money it was so fast and efficient. Whoever is behind this should be extremely proud. It was a fantastic service.”

The benefits of self-serve retirements

In February 2024, Brightwell, the primary service provider to the BT Pension Scheme (BTPS), launched a fully online self-serve retirement journey for BTPS members using IntelliPen.

Throughout 2024, they’ve seen exceptional member engagement and feedback, while the administrator effort expended on retirement cases has fallen to 0%.

Download the annual 2024 Performance Report (PDF).

To complete an online retirement, your members need a current form of government-issued photo identification, like a valid passport or driving licence, and a mobile phone or tablet with a camera.

1. Create a quote and check the details

When a member has created an online quote that they’re happy with they need to carefully check that it covers everything they want it to, and then confirm they want to proceed with the online retirement process.

2. Declare other pensions

Members must provide information about any money they’ve already taken, or plan to take, from other pensions so that the Scheme can check against their lump sum allowances.

3. Confirm personal details

The member portal automatically checks and validates bank details. However, before continuing through the retirement process, members must carefully check that all their personal details are correct.

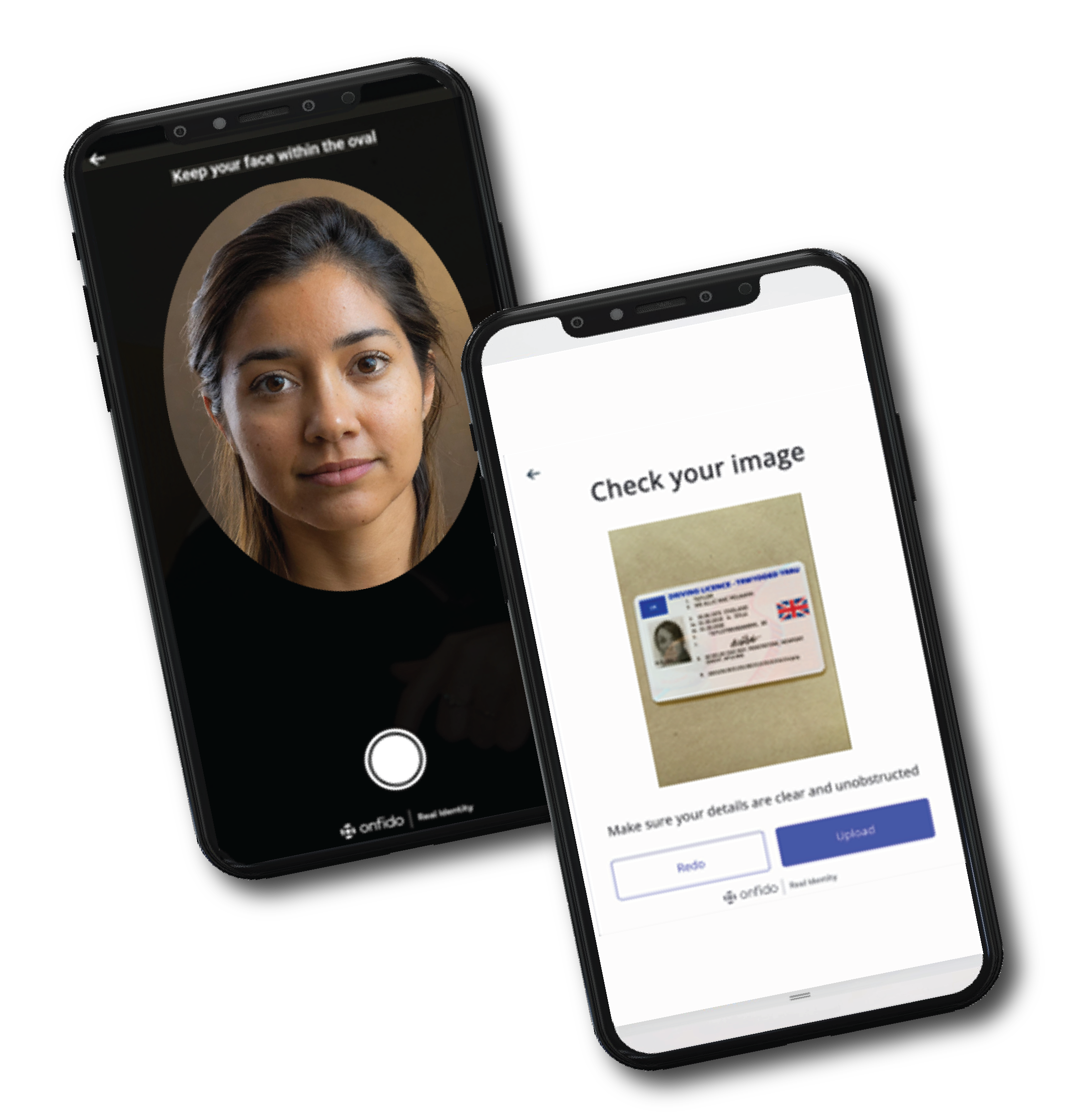

4. Automated ID&V process

They’re asked to take a picture of their photo ID and a selfie, and then upload the images. IntelliPen and Onfido automatically does the rest. The AI-powered technology checks that the ID is genuine and not fraudulent.

5. Put the retirement settlement into payment

Finally, members confirm the details they’ve provided in this process are correct before committing to their retirement option.

If they’ve made a mistake or want to change anything, they can click the edit button before making the final submission.

How we combat cyber-security and fraud threats

We’ve selected Onfido, a global leader in AI-powered digital identity technology to protect members’ data and identities and to prevent fraud.

Onfido’s ID&V solution is embedded into IntelliPen’s online retirement function. It automatically checks and validates personal data so that a retirement submission can be completed securely and without support from your administrators.

This is how IntelliPen lets your members complete the retirement application process from end-to-end themselves.

The solution also supports overseas members by referencing international regulations to meet global compliance requirements and identity standards.

Give your members the gift of self-serve retirements