Pensions Industry Update – Spring Budget 2023

The Spring Budget took place on 15 March and included a major change to taxation for pension schemes. Nick Brain, Team Leader in Client Success at Procentia, explains

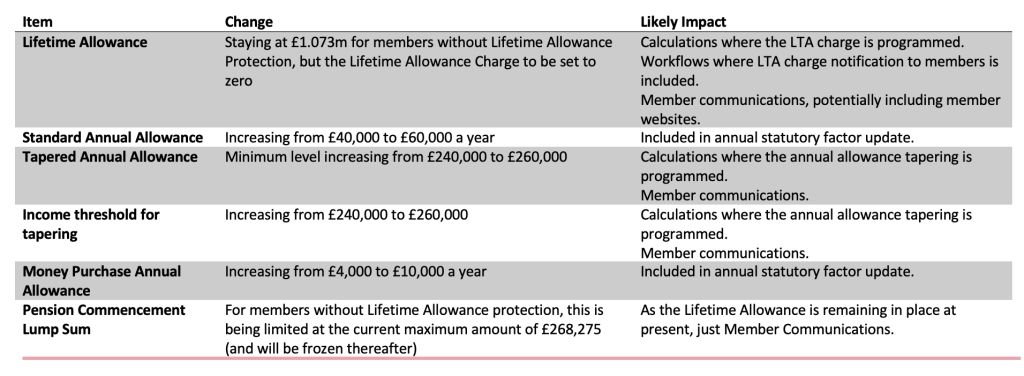

What changes are happening on 6 April 2023?

What changes are happening on 6 April 2024?

The Government has also announced that further changes will be included in a future Finance Act, expected to be effective 6 April 2024. These changes are likely to have a much greater impact.

The abolition of a fundamental tax that has been in place for almost two decades is likely to require changes across administration. The anticipated Finance Act and industry reaction will provide greater clarity.

Although these changes do provide some degree of simplification of the tax system around pensions, this simplification is partially offset by the continued monetary restriction on the amount of Pension Commencement Lump Sum that can be taken. The devil will be in the detail of the Act, but our current understanding is that this limit is across all a person’s registered pension schemes, much like the Lifetime Allowance.

Also, it’s worth noting that certain lump sums which can currently be subject to an LTA charge of 55% (serious ill-health lump sums, LTA excess lump sums, DB lump sum death benefits and uncrystallised funds lump sum death benefits) will be taxed at the recipient’s marginal rate (from 6 April 2023).

As such, it’s a fair assumption that many of the Lifetime Allowance-related administrative requirements at retirement will remain. Members will need to be told how much of the PCLS limit they have taken from a scheme, in a similar way as Lifetime Allowance taken, and schemes will need to request information on the amount of PCLS a member has used up in other registered pension schemes.

The complex Protections that have put in place over the years will also remain, insomuch as they will only affect the amount of Pension Commencement Lump Sum that can be taken.

The latest HMRC Pensions Schemes Newsletter (No. 148) gives a little more information.